What To Do If Your Home Falls Behind On It’s Property Taxes

3 Ways Out – The Ugly Truth About Property Taxes

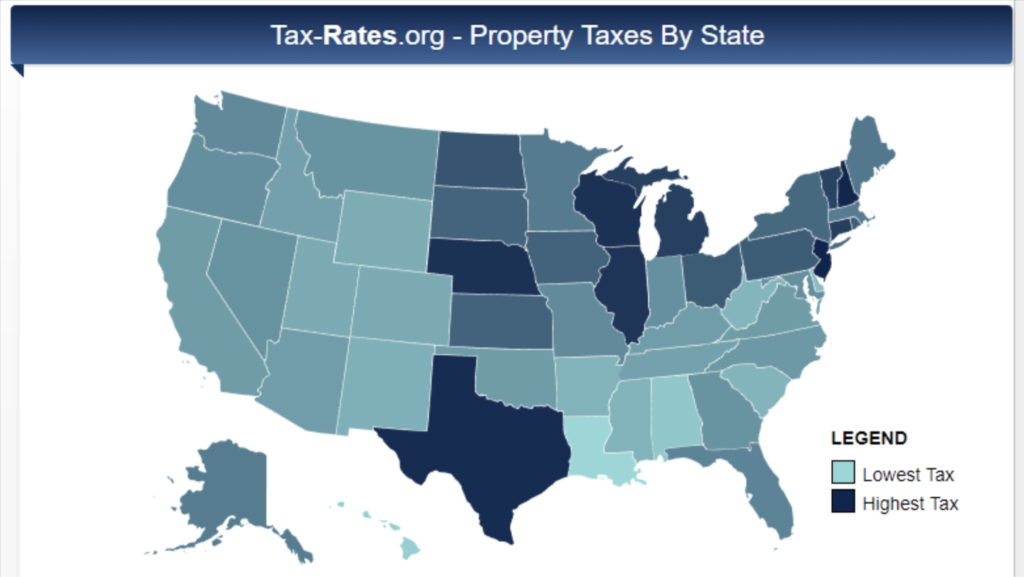

Over the recent years, Texans all across the state have seen their property tax bill skyrocket. In fact, Texans face some of the highest property tax rates across the country.

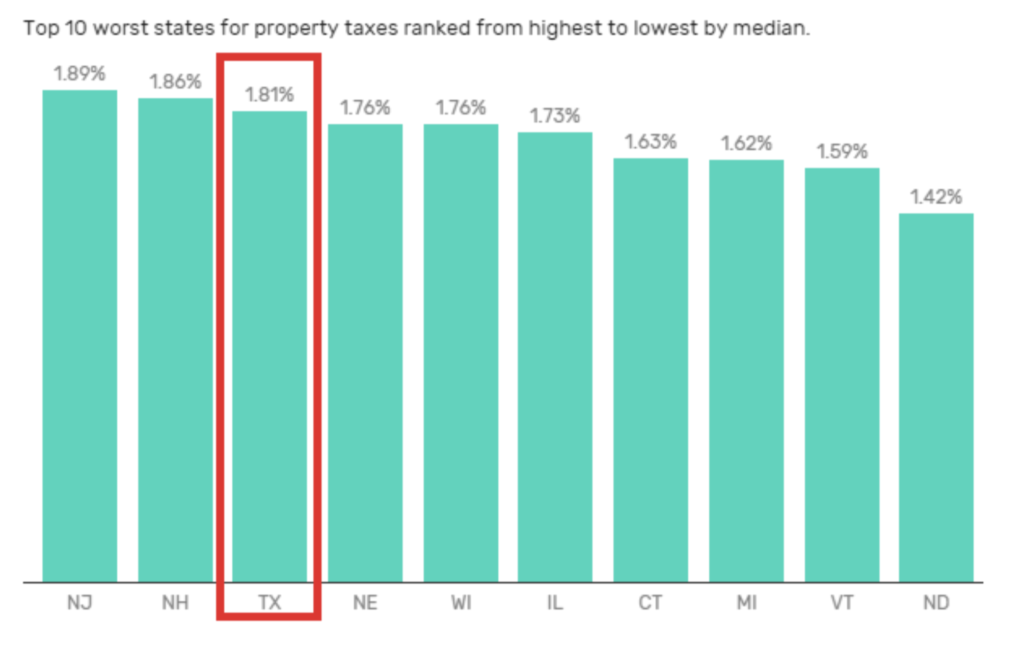

According to a recent study by TheBalance.com Texans are subject to the 3rd highest property taxes in the U.S.

Here’s how we stack up with the worst:

The only states with higher median property taxes are New Hampshire and New Jersey (at 1.86% and 1.89%, respectively). We come in at 3rd worst with a median rate of 1.81% Here in San Antonio, we’re no exception. In fact, according to a recent 2019 report by Tax-Rates.org, on average Bexar County collects 2.12% in taxes on the assessed value of San Antonio homes.

(That’s higher than New Jerseys’ median rate – the worst tax state in the county.)

We’ve seen these property tax rates climb and climb over the years which means more and more dollars leaving our pockets. And if that wasn’t bad enough, there’s another hidden threat that you’re facing: Homes across San Antonio have gone up in value.

Now at first, this sounds like a good thing. And in many ways, it is. But there’s any ugly side to this rise in your properties value: That new (higher) tax rate is now applied to your new (higher) property value.

So what’s that mean for you? A big bill.

This has left residents all over San Antonio in a tough spot, and starts them down a dangerous path: These rising taxes and home values lead to difficulty paying the higher bills. Which often leads to delinquent property taxes. And once property taxes become delinquent, they can quickly snowball as the result of interest rates and penalty fees.

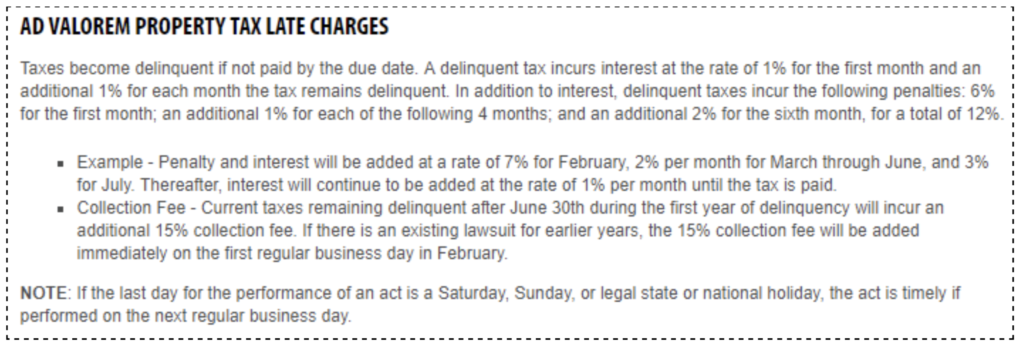

Here’s a breakdown of the current Property Tax Late Charge structure from the City of San Antonio:

So what’s this mean? Let’s Take a Look at a Quick Example:

Say you owe $5,500 in back taxes on your property. Here’s how quickly that bill can grow over 6 months.

At the end of the first month you owe that $5,500 + 1% interest and a penalty of 6%.

= $5,885

Month 2: $5,885 + 2% interest and a penalty of 7%

= $6,414

Month 3: $6,414 + 3% interest and a penalty of 8%

= $7,120

Month 4: $7,120 + 4% interest and a penalty of 9%

= $8,045

Month 5: $8,045 + 5% interest and a penalty of 10%

= $9,252

Month 6: $9,252 + 6% interest and a penalty of 12%

= $10,918

That tax bill of $5,500 grew to nearly twice that in 6 short months.

(And let’s not forget the additional 15% collection fee that will be added to that if not paid.)

As you can see, if left unpaid, the dollar amount owed skyrockets. And if left unpaid long enough, these tax bills lead to eventual foreclosure and repossession of residents homes.

Worse yet, if someone’s home is foreclosed on . . .

- They’re forced out of their home

- They lose all of the equity they’ve built over the years, and

- They’re left with credit difficulties due to the foreclosure (which can make even renting difficult)

We’ve worked with countless families and individuals in San Antonio in this exact situation. And we have good news. There ARE ways out of this mess. Over the years we’ve spent working with San Antonio families is this exact situation, here’s what we’ve learned . . .

Options for Fighting Foreclosure

1. Find the money to settle the debt

This is probably the least helpful (and most obvious) option, but it’s worth stating. For those that have the means to raise cash fast, this is the most direct solution to the problem. In some cases, residents can work out a payment program with the county. But this usually has a deadline and requires a big down payment on the back taxes. For more information on this, get in touch with the Bexar County Tax Assessor Collector’s office. You can visit them in person at 233 N. Pecos La Trinidad at W. Martin or you can call them at (210) 335-2251.

If you don’t qualify for a payment plan with the county, have missed the deadline, or aren’t able to make the down payment – an alternate option for getting your taxes settled is to apply for a property tax loan with a private lender. With these loans, you send your details over to a lender and if they approve you for a loan they pay your tax bill. Your debt is then transferred from the county to the lender, and the lender puts you on a payment plan. The nice thing about this option is that if you’re at the end of your rope with the county, a property tax loan can buy you a second chance at paying down the debt. The drawback to this option is that it doesn’t solve the real problem. It doesn’t actually get rid of any of your debt (or penalties and interest accrued). You just transfer it all from one debt servicer to another.

2. List your house for sale, with a realtor, on the MLS

With this option you’re able to sell your house for a fair market price, pay off your debts, and walk away with any extra cash. The downside of this option is you’ll likely need to do costly repairs around the house before you list, it can take a long time to get the house sold, you’ll have to negotiate back and forth with potential buyers, and you’ll have to pay fees to both your realtor (and the buyers) whenever the house eventually sells. It can be costly and time consuming. Unfortunately with this route, there are no guarantees. For more information on the upsides and downsides of listing with a real estate agent, feel free to give us a call at 210-982-0875 or email us at chelsie@achousebuyer.com.

3. Sell your house as-is to a cash buyer

For those that want to skip the pain of repair, sell their house as-is, and sell their house quick: Selling to a cash buyer is often the best option.

If you feel stressed by the thought of trying to renegotiate your debt with the county . . . Or if the pain of getting your house all fixed up in order to list it with a realtor (with no guarantees) seems like just too much work and money . . .Then selling your house (as-is) to a cash buyer is likely a good option for you. At the very least, you should consider getting some cash offers to help weigh your options. Legitimate cash buyers can generally give you a cash offer on your home in a day or two. And if you like the offer you just pick a day for the sale and they put the money in your hand.

It’s the most convenient option for people that want a sure thing, want their home sold quick, and don’t want to pay any fees. The catch here is you need to make sure your cash buyer is legitimate. There are many imitators out there who call themselves “cash buyers” but don’t actually have the money to buy your house. These guys often just wind up wasting your time before they attempt a bait and switch. Finding someone you can trust is key.

Here are 7 quick-tips that you can use to screen any cash offer that you get:

- Make sure the buyer deposits at least 1% earnest money

- Pay close attention to the option period (it should not be too long)

- Use a standard Texas Real Estate Commission contract

- Be wary of repeated showing with multiple “contractors” or “partners”

- Check the buyer’s name. Make sure it doesn’t have “and/or assigns” written after it on the contract. This is a sure sign that your buyer isn’t actually a buyer (they’re just planning to sell the contract on your home).

- Ask for proof of funds

- Ask for references

For the full report with all the details on how to determine if a cash-buyer or investor is legitimate, shoot us an email (at chelsie@achousebuyer.com) and ask us for a free copy of our cash-buyer guide called How to Spot a Fake: 7 Ways to Tell if The Cash-Offer for Your Home is the Real Deal.

What To Do Next

Now, everyone’s situation can be slightly different. So it’s unlikely that more than one of these options will be right for any one person. What’s most important, if your homes property taxes have fallen behind, is figuring out which option is right for you. Now. If this applies to you, a family member, or a friend . . .Regardless of what option turns out to be the right one, you MUST act now to fix this problem before it becomes entirely unmanageable.

And if selling your house as-is to a cash buyer is an option you want to pursue (or even if you’re just interested in exploring), give us a call or text at 210-982-0875 or email us at chelsie@achousebuyer.com.

We will give you a cash offer on your home that you can count on. And you’ll have no obligation to accept it. We’ll never charge any fees or commissions and we’ll never ask you to make any repairs. We will buy your house as-is.

Wondering how other people feel about us? Check out what our past clients have to say.